Restaurant Consumers' Multidimensional Definition of Value Emphasizes the Overall Dining Experience

/As consumer attitudes shift, Technomic Inc.'s study explores current foodservice value proposition.

CHICAGO, Sept. 22, 2015 – PRNewswire

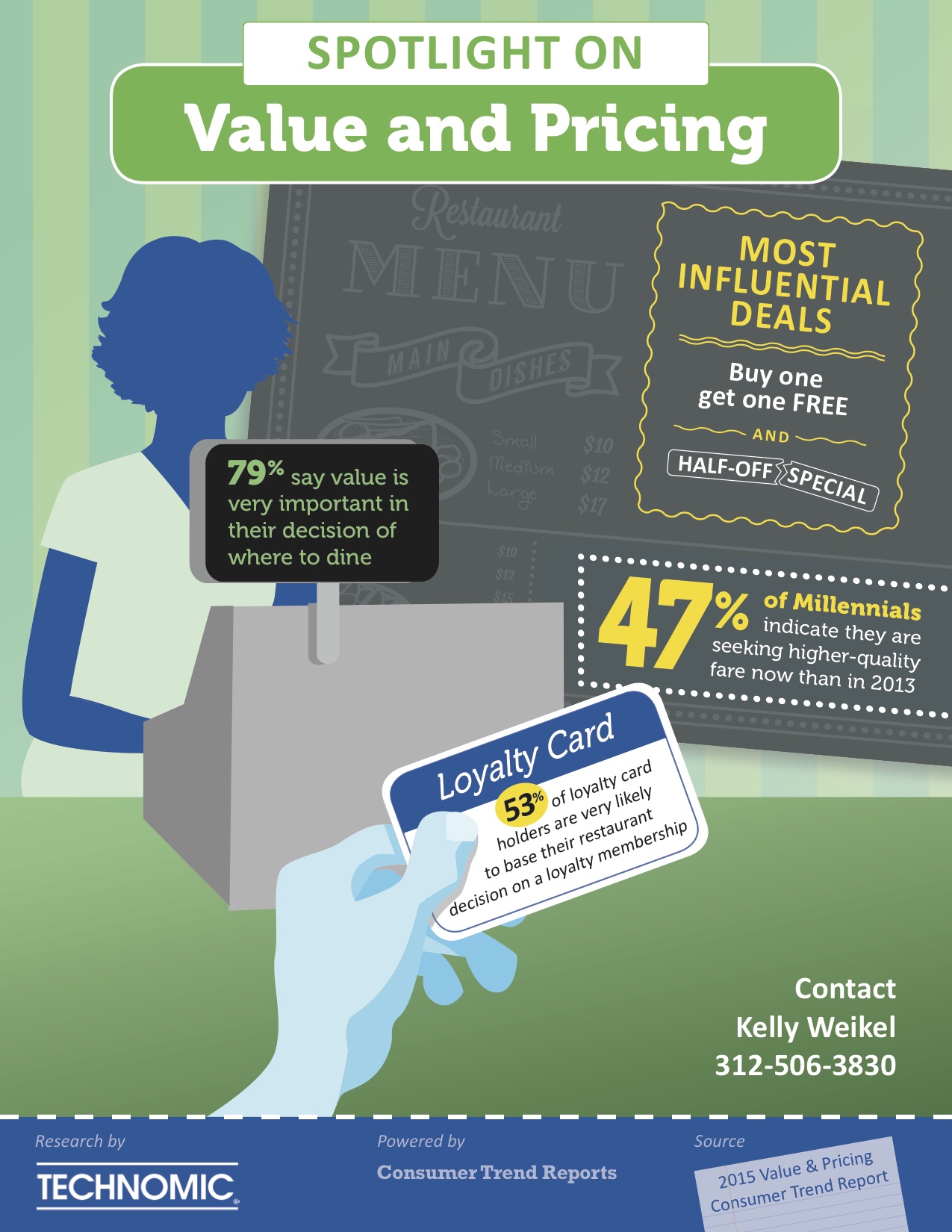

Nearly 80 percent of consumers say that "value" is very important in their decision of where to dine—but their definition of foodservice value depends on many factors, including service and, increasingly, overall ambiance and the quality of menu offerings. While price will always play a major role, delivering on these multidimensional elements of value is crucial as consumer attitudes toward dining out shift and operational costs rise. To combat this, operators must increase emphasis on the overall dining experience, finds Technomic's Value & Pricing Consumer Trend Report.

"While food quality remains essential, the overall experience is becoming more important to today's diners who are looking for fun, social and unique dining occasions," suggests Kelly Weikel, director of consumer insights. "Service and atmosphere make up about 40 percent of Gen Zers' and Millennials' value equations at all types of limited- and full-service restaurants. They are looking for experiences they can share—both by connecting with others in the dining party and through social media."

Compiling findings from more than 1,500 U.S. consumers, as well as Technomic's MenuMonitor, Consumer Brand Metrics and Top 500 Restaurant Chain Report, the Value & Pricing Consumer Trend Report also reveals:

- 47 percent of Millennials indicate they are seeking higher-quality fare more now than in 2013;

- 53 percent of loyalty card holders are very likely to base their restaurant decision on a loyalty membership;

- The most influential deals are "Buy One Get One Free" and "Half-Off Specials."

The Value & Pricing Consumer Trend Report is one of many topics in Technomic's Consumer Trend Report series offering the most current analysis, insight and opportunities to help grow your business. Our best-in-class intelligence combines 50 years of foodservice expertise with critical findings from over 7,000 menus per year and nearly 30,000 annual consumer interviews.

About Technomic: Only Technomic, A Winsight Company, delivers a 360-degree view of the food industry. We impact growth and profitability for our clients by providing consumer-grounded vision and channel-relevant strategic insights. Our services range from major research studies and management consulting solutions to online databases and simple fact-finding assignments. Our clients include food manufacturers and distributors, restaurants and retailers, or other foodservice organizations, and various institutions aligned with the food industry. Visit us at www.technomic.com.

(via PR Newswire)