Minimum Wage Changes to New York’s Fast Food Industry

/As we previously discussed in May and July of this year, wage and hour requirements for the fast food industry in New York State are changing starting in the new year. These changes, which go into effect on December 31, 2015, result from recommendations made by the Fast Food Wage Board, which Governor Andrew Cuomo instructed Acting State Labor Commissioner Mario J. Musolino to empanel in May of 2015. The Wage Board announced its recommendations in July, and Acting Commissioner Musolino accepted those recommendations in September of 2015.

The new requirements apply to any employee working for a covered “Fast Food Establishment” if the employee’s job duties included at least one of the following: customer service, cooking, food or drink preparation, delivery, security, stocking supplies or equipment, cleaning, or routine maintenance.

A covered “Fast Food Establishment” is any business that meets the following criteria:

- Primarily serves food or drinks, including coffee shops, juice bars, donut shops, and ice cream parlors; and

- Offers limited service, where customers order and pay before eating, including restaurants with tables but without full table service, and places that only provide take-out service; and

- Is part of a chain of 30 or more locations, including individually-owned establishments associated with a brand that has 30 or more locations nationally.

The higher minimum wage rates for covered employees are as follows:

New York City:

- $10.50 per hour beginning December 31, 2015;

- $12.00 per hour beginning December 31, 2016;

- $13.50 per hour beginning December 31, 2017; and

- $15.00 per hour beginning December 31, 2018.

New York State (excluding New York City):

- $9.75 per hour beginning December 31, 2015;

- $10.75 per hour beginning December 31, 2016;

- $11.75 per hour beginning December 31, 2017;

- $12.75 per hour beginning December 31, 2018;

- $13.75 per hour beginning December 31, 2019;

- $14.50 per hour beginning December 31, 2020; and

- $15.00 per hour beginning July 1, 2021.

The New York State Department of Labor has now published a revised Hospitality Industry Wage Order codifying the new requirements in addition to a page addressing a number of frequently asked questions (FAQs) to assist employers with implementing the new requirements.

There are several points to note from the new wage order and the FAQs, which employers should watch as they implement changes to their policies in an effort to remain in compliance with the law:

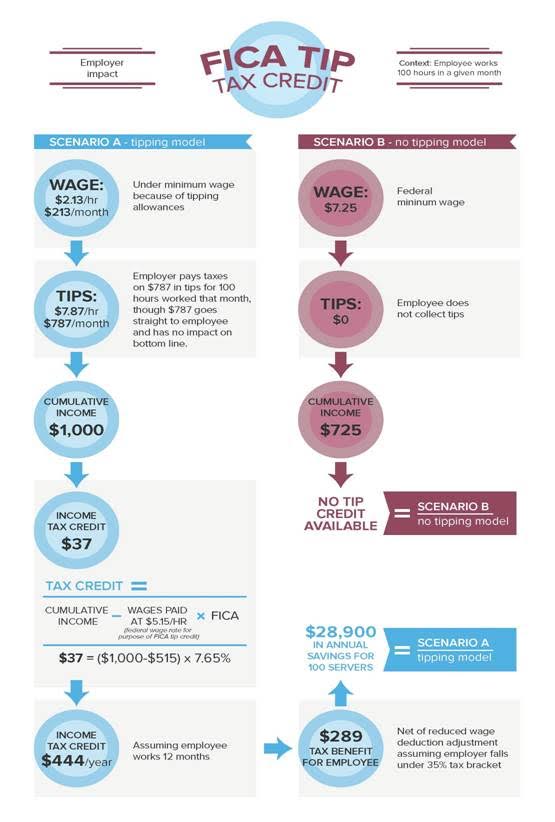

- Tip credits are not available for fast food employees. However, we note that a fast food establishment is one where patrons order and pay before eating and which offers limited service. So, if employees were previously receiving a tip credit wage because they were waiting on and regularly receiving tips from customers, it is very possible, if not likely, that the employees will not be considered fast food employees under the new requirements.

- Although fast food workers do not regularly earn tips and an employer cannot take a tip credit for them, fast food employees must be allowed to keep any tips that they do earn.

- With the increase in the minimum wage for fast food employees, employers must be sure to pay the higher rate for spread-of-hours pay and call-in pay, should those apply.

- A “fast food establishment” need only have 30 locations nationally–not 30 locations in New York State–to qualify for coverage.

- The 30 establishments need not be commonly owned and operated to trigger coverage as a “fast food establishment.” The 30 establishments can be operated as a franchise if the franchisor and franchisee own or operate 30 establishments.

- A “chain” is defined as a set of establishments that share a common brand or that are characterized by standardized options for decor, marketing, packaging, products, and services.

(via JDSupra)